The Unsung Hero Of Systematic Investing

May 31, 2023

We know that we don’t know.

—Larry Hite

In our view, the unsung hero of systematic investing is being able to allow what’s working to continue working without any bias toward predictions or emotions.

A systematic investment process is geared toward doing just that. We seek to maximize compounding rates, and we strive to keep them consistently high.

In a year like 2023, this facet of trend following become particularly important. Thus far, the major stock indices have been influenced by a few outliers, while most stocks have stagnated. This can be observed through a performance comparison between the equal-weighted and market-cap weighted S&P 500 indices.

In this month’s Investment Update, we examine how our systematic investment strategies have adapted to the market conditions we have witnessed year-to-date. We acknowledge that trend-following strategies are not flawless, nor are they designed to be. However, based on our experience, they generally position you with a higher probability of capitalizing on what is working, regardless of the prevailing market environment.

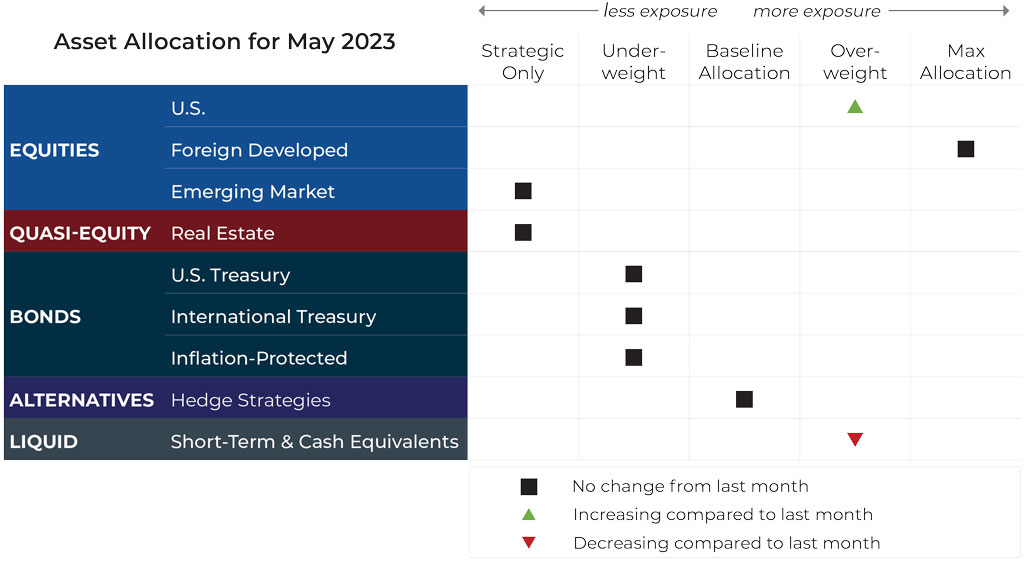

But first, here’s a summary of the global asset classes utilized in our portfolios and their exposures for June.

Sourcing for this section: Yardeni Research, Inc., “Performance 2023 S&P 500 Sectors and Industries,” 5/23/2023; Barchart.com, S&P 500 EW Invesco ETF (RSP), 5/30/2023; and Barchart.com, S&P 500 EW Invesco ETF (RSP), 5/30/2023

Asset Allocation Update

Source: Blueprint Investment Partners

Adjustments can vary across strategies depending on each strategy's objectives. What's illustrated above most closely reflects allocation adjustments for the Growth Strategy. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Diversification among investment options and asset classes may help to reduce overall volatility.

U.S. Equities

International Equities

Exposure will not change. Foreign developed equities continue to experience uptrends across both timeframes, while emerging market equities continue to have downtrends.

Real Estate

U.S. & International Treasuries

Exposure will decrease and remain underweight. Both U.S. and international bonds now have downtrends across both timeframes.

Inflation-Protected Bonds

Exposure will decrease to its minimum as the intermediate-term trend joins the long-term trend in negative territory.

Alternatives

Exposure will not change. The baseline allocation for gold is also our highest limit, so we are already at the maximum allocation as the asset class continues to experience uptrends over both timeframes.

Short-Term Fixed Income

Exposure will increase, as it receives allocations from weaker U.S., international, and inflation-protected bonds.

Asset-Level Overview

Equities & Real Estate

Last month we highlighted the tight trading range for U.S. markets in April and how it was among the narrowest ranges of the last 30 years. May was not much different for the S&P 500 Index. Significantly, the index secured a new year-to-date high, but only briefly. Within a few days it re-entered the range experienced for most of 2023.

Broadly for U.S. equities, trends continue to be positive. Larger technology companies and more growth-oriented names continued to be strongest, with uptrends across all timeframes. Other areas, such as value, mid caps, and small caps, are in downtrends.

The result for June will be almost exactly what it was for May, with exposure overweight to U.S. equities but tilted significantly toward large caps, tech, and growth.

Foreign developed equities failed to make a new 2023 high in May but continued to trade at the top of the 2023 range. Uptrends remain locked in place for now. Exposure is at its maximum due to the uptrends, as well as the presence of weakness for emerging markets. Emerging markets remain in downtrends in both timeframes and is at the minimum in terms of exposure.

Real estate securities continue to experience downtrends across both timeframes. As a result, our systematic investing portfolios remain at their minimum allocation.

Fixed Income & Alternatives

From a price perspective, May was not favorable for fixed income of any meaningful duration. From long-term (20+ years) all the way to short-term (1-3 years), prices either moved back into downtrends across all timeframes or digressed in that direction. The same behavior also applied for international and inflation-protected bonds. Some segments, such as 20+ years Treasuries even came close to their 2023 low.

The bright spot was that yields continued to be favorable compared to recent history. Treasuries with less than a year duration provided yields north of 4%. Inflation remained high, eroding some of that benefit. The result for our systematic investing portfolios is underweight exposure to bonds of any duration over 1 year and overweight exposure to shorter-term bonds.

Gold retraced in May but remains in uptrends. It has been one of the leading asset classes for 2023 and thus will continue to be at its maximum exposure in our systematic investing portfolios.

Sourcing for this section: Barchart.com, S&P 500 Index ($SPX); 1/1/2023 to 5/24/2023; Barchart.com, Nasdaq QQQ Invesco ETF (QQQ), 1/1/2023 to 5/25/2023; Barchart.com, Growth ETF Vanguard (VUG), 1/12023 to 5/25/2023; Barchart.com; FTSE Developed Markets Vanguard (VEA), 1/1/2023 to 5/26/2023; Barchart.com, 20+ Year Treas Bond Ishares ETF (TLT), 1/1/2023 to 5/24/2023; Morningstar.com, SPDR® Blmbg 1-3 Mth T-Bill ETF, 5/26/2023; and Barchart.com, Gold Trust Ishares (IAU), 1/1/2023 to 5/25/2023

3 Potential Catalysts For Trend Changes

Housing Prices: The national median existing-home price fell in April from a year prior. It was the steepest year-over-year price decline since January 2012. A steep rise in mortgage rates since the start of 2022 has made home purchasing less affordable to most buyers and brought down demand. Another issue is a shortage of inventory, which is limiting options for future home-buyers.

Financial Well-Being: Results of a fall 2022 survey by the Federal Reserve were released in May and indicated that Americans have significantly less confidence in their financial well-being, as high inflation eroded earnings and savings. The survey found that rising prices left more families in an economically precarious place, despite households being able to benefit from a strong labor market. Adults reporting being worse off financially in 2022 than a year earlier climbed to 35%, which was the highest on record going back to 2014.

Less School, More Money: More high-school graduates are skipping college and going straight into blue-collar jobs. The college enrollment rate for recent U.S. high-school graduates, ages 16 to 24, declined to 62% last year from 66.2% in 2019. College enrollment has declined by about 15% in the past decade. Meanwhile, the unemployment rate for teenage workers, ages 16 to 19, fell to a 70-year low of 9.2% last month, which is fueling larger pay increases.

Sourcing for this section: The Wall Street Journal, “Home Prices Posted Largest Annual Drop in More Than 11 Years in April,” 5/18/2023; The Wall Street Journal, “Inflation Hit Americans’ Finances Last Year, Fed Finds,” 5/22/2023; and The Wall Street Journal, “More High-School Grads Forgo College in Hot Labor Market, 5/29/2023

The S&P 7 Versus The S&P 493

Victorious warriors win first and then go to war, while defeated warriors go to war first then seek to win.

—Sun Tzu, “The Art of War”

In basketball, if you have the best player on the floor, you often stand a good chance of emerging victorious.

This has generally been correct in our lifetime, starting with Kareem and Magic for the Lakers, Bird for the Celtics, MJ (best of all time…just saying) for the Bulls, as well as Shaq, Kobe, and LeBron.

There have been exceptions that could be argued, from the Bad Boy Pistons to the early 2000s Pistons, and the Raptors a few years back. However, one need look no further than this year and two-time MVP Nikola Jokic to see yet another example of a team with arguably the best player being in the hunt for a title.

As the NBA Finals get ready to kick off in June, there’s an interesting parallel to what we have in the markets right now. If you have the “best” stocks in your portfolio, you are likely having a great year and on pace to meet your goals. If not, you are potentially back to the drawing board just like NBA general managers who missed the playoffs or were eliminated.

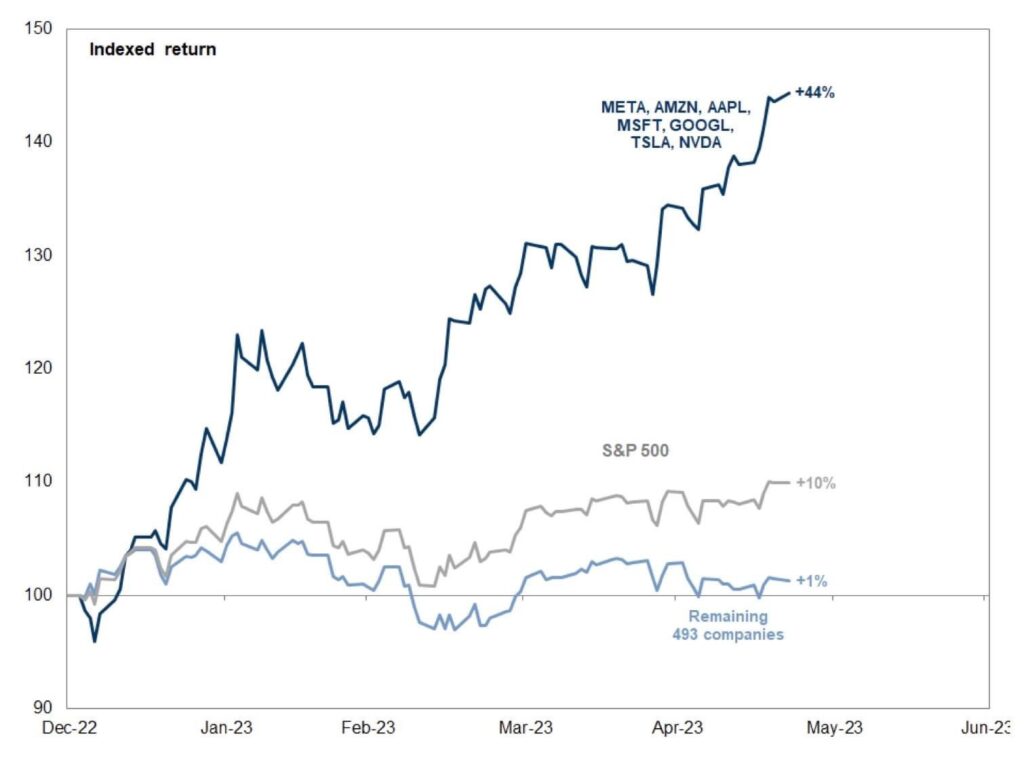

The S&P is having a fairly good year, but that is being almost entirely driven by just a few stocks.

The S&P 7 vs. The S&P 493

Source: Twitter.com, @Growth_Value_, 5/26/2023

We think the above is an amazing graphic display of the power of leaning into the best-performing names. Just seven names in a portfolio of 500 stocks have returned 44%, with the remaining returning 1%.

Now, before you beat yourself up for not owning one or some of the best seven, you should remember that even Cathie Wood sold NVDA in January.

The takeaway for us is this: If you are relying on your intuition or research skills and not a systematic investing process for determining which stocks to own, then you are doing yourself a disservice.

We are fond of saying, “If it isn’t repeatable, it isn’t useful,” and that, “Consistently good beats occasionally great.” Our systematic investing approach for owning funds, stocks, and bonds is based on those principles. Our trend following process isn’t perfect and can’t make guarantees, but in our experience, we think it improves the odds of owning strong stocks like The S&P 7 and minimizing exposure to some of The S&P 493.

Our systematic investing portfolios have owned many, but not all, of The S&P 7 for most of 2023.

Tesla, for example, has generated most of its 2023 return while in a deep downtrend due to taking a beating in 2022. We ignored most of the first portion of 2023’s increase and just recently started dipping our toe back in. During the stock’s decline in 2022, we were generally out of Tesla, which is an equally important point to note, in our view.

Do The Ordinary Better Than Anyone Else

Chuck Noll, who coached the Pittsburgh Steelers to four Super Bowl titles once said, “Champions are champions not because they do anything extraordinary, but because they do the ordinary things better than anyone else.” We think this applies to a systematic investing process.

Using a systematic investing approach is not extraordinary or a silver bullet. It’s a fairly straightforward and repeatable investing process. But, in our opinion, it is the most compatible approach for achieving long-terms goals because it provides good odds of being on the winning side of market moves while avoiding catastrophic declines.

Sourcing in this section: Fortune.com, “Cathie Wood says ARK dumped Nvidia shares before 160% surge because it’s ‘just pivoting’ to other A.I. plays,” 5/26/2023 and Barchart.com, Tesla Inc (TSLA), 1/1/2022 to 5/26/2023

Let's Talk

If you have any questions about what transpired in the markets last month or portfolio positioning for the month ahead