Oh Come, All Ye 2024 Predictions!

December 29, 2023

The future ain't what it used to be.

—Yogi Berra

It’s a joyous time of the year. Many children are writing thank you notes to Santa for making their Christmas dreams come true. Young couples are planning their first New Year’s Eve together. And firms like ours are getting an absolute laugh from all the 2024 market predictions articles we see shared by financial services media and asset managers.

At Blueprint Financial Advisors, we love predictions. Not to make them, but to make fun of them.

The idea that the average asset manager, let alone investor, can consistently predict the direction of any market or instrument reliably enough to beat a passive index over a very long time period is amusing to us. It’s akin to your buddy saying they can beat the 12th man on an NBA team in a game of 1-on-1. When you hear something like that, you may not actually laugh out loud, but inside you are cackling. That’s how we feel when we read or hear market predictions.

In this month’s Investment Update, we discuss how predictions are a bit dangerous because they are fertile ground for making investment decisions emotionally only to justify them intellectually. We also share why we feel so strongly about flipping the order to start from the intellectual standpoint, which we believe means having a systematic and repeatable investment process.

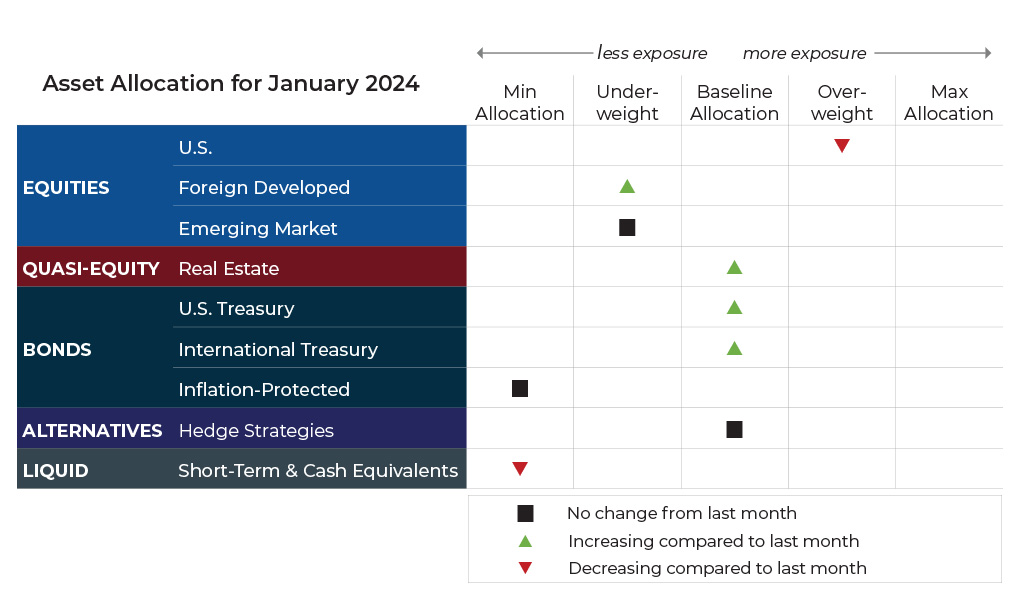

But first, here’s a summary of the global asset classes utilized in our portfolios and their exposures for January.

Asset Allocation Update

Source: Blueprint Investment Partners

Adjustments can vary across strategies depending on each strategy's objectives. What's illustrated above most closely reflects allocation adjustments for the Growth Strategy. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Diversification among investment options and asset classes may help to reduce overall volatility.

U.S. Equities

International Equities

Exposure will increase but remain underweight. Both foreign developed and emerging market equities now have intermediate-term uptrends, with the former also gaining a long-term uptrend. The relative weakness of international equities versus U.S. will subdue allocation increases to minor adjustments.

Real Estate

U.S. & International Treasuries

Exposure will increase and return to baseline allocation, as some long-term trends in the asset class have become positive. The relative strength of nominal bonds versus inflation-indexed bonds will continue to boost the allocation, pushing it to baseline despite having some long-term downtrends.

Inflation-Protected Bonds

The intermediate-term trend has switched from declining to increasing, but the relative weakness of the asset class versus nominal Treasuries will keep exposure at its minimum.

Alternatives

Exposure will not change, as trends in gold remain positive across both timeframes.

Short-Term Fixed Income

Exposure will continue to decrease to its minimum as higher-duration fixed income instruments strengthen.

Asset-Level Overview

Equities & Real Estate

The Santa Claus rally, which seemingly started in late October this year, continued in December. U.S. indexes pushed to new yearly highs and are poised to challenge new all-time highs as the year concludes. The fourth quarter push in stocks has seen the S&P 500 Index return a whopping 15% since the October 27 low. Increases continue to be both strong and broad, with every major cap size and style benefiting. Even value and dividend stocks, which have lagged significantly in 2023, have managed to produce positive returns for the year. Equity returns in the U.S. are on the verge of being generally above average, even if the road was not always easy or widespread. Given all the negative sentiment throughout 2023, we think this should be a lesson for investors to trust the trends.

Internationally, returns were a bit more mixed in December. Foreign developed equities generated a modest gain to finish up double-digits. However, emerging markets lagged due to underperformance among Chinese equities, which are the largest component of emerging markets. China’s equity markets are making new 2023 lows as the year ends, which is a bad sign given it’s such an outlier versus so many other bullish equity markets globally.

Few assets have benefited more from the impending dovish stance by the Fed than real estate. With interest rates theoretically at a peak for now, real estate assets have seemingly troughed and managed to turn persistent downtrends into budding uptrends. The result is that Blueprint Financial Advisors portfolios will move back to baseline allocations for the first time in almost two years.

Fixed Income & Alternatives

Just as short-duration fixed income was becoming the hottest investment trend since crypto, rate pressure has eased and pushed bond prices higher to leave short-duration returns in the dust. Almost no one would argue that equity returns since the end of October have been anything but extraordinary, but did you know that long-term bonds have been even better? As mentioned earlier, the S&P 500 Index has produced a 15% increase during that span. The 20+ Year Treasury Bond Ishares ETF (TLT) has returned almost 19% in that same time. The emergence of uptrends across fixed income instruments will cause Blueprint Financial Advisors portfolios to increase exposure.

Gold prices have also joined the party, surviving a minor dip in December to produce a new 2023 high closing price. Trends continue to be positive as the year ends. As a result, exposure in our portfolios will not change and remains at its baseline allocation.

Sourcing for this section: Barchart.com, S&P 500 Index ($SPX), 1/1/1980 to 12/26/2023; Barchart.com, Dow Jones U.S. Index ($DUSA), 8/1/2006 to 12/26/2023; Barchart.com, Nasdaq QQQ Invesco ETF (QQQ), 3/1/1999 to 12/26/2023; Barchart.com, “China Largecap Ishares ETF (FXI), 1/1/2023 to 12/26/2023; Barchart.com, 20+ Year Treas Bond Ishares ETF (TLT), 10/1/2023 to 12/26/2023; and Barchart.com, Gold Trust Ishares (IAU), 1/1/2023 to 12/26/2023

3 Potential Catalysts For Trend Changes

Soft Landing Imminent? The personal-consumption expenditures (PCE) price index, which is the Fed’s preferred inflation measure, fell 0.1% in November from the previous month. This marked the first decline since mid-2020. Prices were up 2.6% year over year, which is close to the 2% target set by the Federal Reserve for annual price increases.

Spending and Hiring: Consumer spending was up 0.2% for November, higher than the 0.1% increase in October. It is an increasing sign of confidence in the economy from American households. Additionally, the labor participation rate for workers between 25 and 54 is rising to near the highest rate in more than 20 years. Ideally, this should make it easier for employers to find workers, which should prevent wages from increasing so fast that they put upward pressure on broader inflation.

Housing Turnaround: Mortgage rates have dropped to the lowest level since June. The average rate for a standard 30-year fixed mortgage declined about a quarter percentage point to 6.67%, according to Freddie Mac. Rates are down more than a full percentage point from their recent peak near 8% this fall. Coincidentally, home sales moved up from 13-year lows in November. Existing home sales, which comprise most of the housing market, increased 0.8% in November from the prior month, as reported by the National Association of Realtors.

Sourcing for this section: The Wall Street Journal, “Prices Fell in November for the First Time Since 2020. Inflation Is Approaching Fed Target.” 12/22/2023; The Wall Street Journal, “Mortgage Rates Fall To 6-Month Low,” 12/21/2023; and The Wall Street Journal, “Home Sales Ticked Up in November After 5 Months of Declines,” 12/20/2023

Don’t Make Investment Decisions Emotionally, Then Justify Them Intellectually

The essence of strategy is choosing what not to do.

—Michael Porter

In an Investment Update from earlier this year, we checked in on the “12 Stock Market Predictions for 2023” Sean Williams shared for The Motley Fool. At the time, we noted that it wasn’t looking good for those 12 prognostications.

Checking back in on those predictions as the year concludes, we see the final accuracy rate is around 8%. That’s right, 1 out of the 12. Williams shouldn’t feel too bad though, as he has plenty of company.

Let us get one thing straight, like almost everyone else, we stink at predictions. It’s why we don’t make them, don’t think others can successfully make them on a consistent basis, and ultimately eschew them for the opposite of predictions: a rules-based, systematic, and repeatable process for portfolio management.

What matters is not what you think will happen, but what you do with that thought. In other words:

- When do you enter the market (buy)?

- How much do you buy?

- When do you exit to increase your chases of leaving with a profit (sell)?

- When do you to accept defeat to avoid potentially catastrophic levels of losses (sell)?

These are the key decisions that determine outcome over time. One can make all the great predictions they want, but without a process for managing these questions, it doesn’t matter.

We are fond of saying that investment decisions are often made emotionally and justified intellectually. Predictions are fertile ground for emotional decisions and intellectual justifications. On the other hand, using a repeatable process for making investment decisions flips the order to start from the intellectual standpoint. History tells us that starting from the intellectual standpoint gives investors a better chance of attaining two things:

- Achieving the investment goal

- Managing emotions during periods of euphoria and fear in the market

We believe almost all consistently successful asset managers rely on process over prediction. Even when an investor makes decisions on discretionary factors instead of algorithmic ones, it is possible to do so with a process that is rooted in odds rather than predictive opinions. For example, some might call Warren Buffett’s decision on a given investment a prediction, but what we see is a calculated, systematic bet he has made based on a variety of fundamental factors.

As you know from reading our monthly updates, at Blueprint Financial Advisors, we believe in and act on systems, recommending regular rebalances to tilt portfolios toward stronger assets and away from weaker ones. Our goal is to remove guesswork and angst about the market’s direction for our clients.

As we roll into 2024, our focus remains the same: We are committed to serving our clients. We are and will continue to make sizeable investments in new ways to help you thrive.

Let's Talk

If you have any questions about what transpired in the markets last month or portfolio positioning for the month ahead