Our New Refrain: ‘First Time In a While’

January 31, 2023

We've fallen into a trap of ever-widening orbits of contact, and there is a total disregard for the present moment.

—Jerry Seinfeld

It seems like the world of trading and investing is full of adages. They’re not as creative as “festivus” or “anti-dentite,” but quips like, “Buy the rumor and sell the news,” and, “Sell in May and go away,” are a few that come to mind. One of those axioms that is particularly timely is, “The market has no memory.” This is one of those that is just true enough to make you ponder its validity.

As a believer in systematic investing, we wrestle with this statement:

- On the one hand, it seems everyone pays attention to calendar year performance. Investors at all levels remember prior year rates of return, which can lead to biases and misplaced expectations. It is also well-established in the data that trends exist and can persist over long periods.

- On the other hand, you can look at the history of rolling or calendar year performance, which appears to be completely random.

We think the best way to cut through this noise is to use a systematic investing process that is adaptable and not dependent on any one market environment for success.

In this month’s Investment Update we discuss our own refrain – “first time in a while” – which captures how we are increasing exposure in certain asset classes for the first time in many months (or years). Using our systematic investing process helps us remain adaptive and nimble, eliminates our “memory” of the distant past, and focuses us on what is happening in the moment.

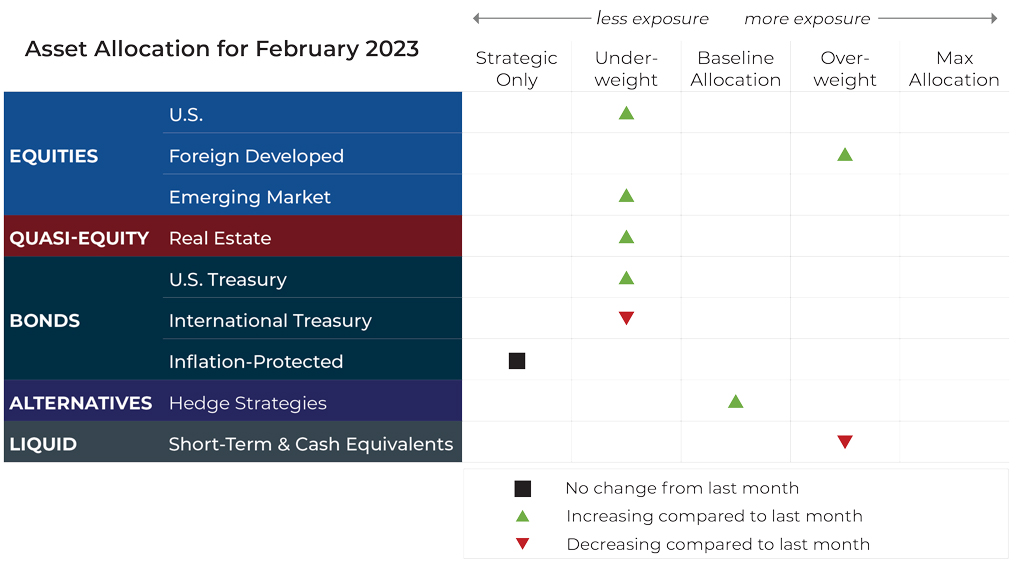

But first, here’s a summary of the global asset classes utilized in our portfolios and their exposures for February.

Asset Allocation Update

Adjustments can vary across strategies depending on each strategy's objectives. What's illustrated above most closely reflects allocation adjustments for the Growth Strategy.

U.S. Equities

International Equities

Exposure will increase, as both foreign developed and emerging market equities strengthen. Foreign developed equities now have uptrends across both timeframes, while emerging markets have an intermediate-term uptrend coupled with a long-term downtrend.

Real Estate

U.S. & International Treasuries

Exposure will increase, as U.S. Treasuries join their international counterparts with an intermediate-term uptrend. The long-term trend remains negative.

Inflation-Protected Bonds

Exposure will not change and is at its minimum allocation due to downtrends across both timeframes.

Alternatives

Exposure will increase, as gold produces a long-term uptrend and joined the pre-existing intermediate-term uptrend.

Short-Term Fixed Income

Exposure will decrease, as exposure returns to strengthening assets such as U.S. and international equities as well as fixed income and gold.

Asset-Level Overview

Equities & Real Estate

U.S. large cap equities continued to be range-bound in January, providing a positive return but ultimately failing to break the December high. Mid-cap equities challenged recent highs more strongly and performed better than their large-cap peers. Small-caps are arguably the strongest-performing segment of the three right now, as well as closest to having both intermediate- and long-term uptrends. Our portfolios will increase exposure to all three but remain underweight versus the baseline targets.

Foreign developed equities emerged as the strongest equity asset class as of late and will move into an overweight status in our portfolios for the first time in years. The long-term trend is turning positive, joining the intermediate-term trend. This will be the first long-term uptrend since late 2021.

Emerging market equities came close to triggering uptrends in December, and the strengthening continued in January. Driven by China, this segment will experience an intermediate-term uptrend heading into February, and all our portfolios will see an exposure increase. The long-term trend remains negative for now but is making progress toward an uptrend that could come as early as March.

Real estate securities have been battered by interest rate hikes but also experience an intermediate-term uptrend. The long-term trend remains negative. As a result, all our portfolios continue to be underweight, but exposure will again increase from the minimum allocation.

Fixed Income & Alternatives

Like their equity counterparts, multiple segments of the yield curve in U.S. fixed income have strengthened to intermediate-term uptrends. Longer-duration U.S. Treasuries are arguably the strongest, followed by intermediate-term, then short-term bonds. Our portfolios will remain underweight overall but experience the first meaningful increases in some time.

Gold continues its steady climb from early November lows and is at its highest level since last summer. Exposure will increase from underweight to target weight as the long-term trend joins the intermediate-term trend in positive territory.

Sourcing for this section: Barchart.com, S&P 500 SPDR (SPY), 1/1/2022 to 1/30/2023; Barchart.com, Midcap ETF Vanguard (VO), 1/1/2022 to 1/30/2023; Barchart.com, Smallcap ETF Vanguard (VB), 1/1/2022 to 1/30/2023; Barchart.com, FTSE Developed Markets Vanguard (VEA), 1/1/2021 to 1/30/2023; Barchart.com, Value ETF Vanguard (VTV), 1/1/2022 to 1/30/2023; Barchart.com, Growth ETF Vanguard (VUG), 1/1/2022 to 1/30/2023; Barchart.com, China Ishares MSCI ETF (MCHI), 1/1/2022 to 1/30/2023; Barchart.com, 20+ Year Treas Bond Ishares ETF (TLT), 1/1/2022 to 1/30/2023; Barchart.com, 7-10 Year Treasury Bond Ishares ETF (IEF), 1/1/2022 to 1/30/2023; Barchart.com, 3-7 Year Treas Bond Ishares ETF (IEI), 1/1/2022 to 1/30/2023; Barchart.com, 1-3 Year Treasury Bond Ishares ETF (SHY), 1/1/2022 to 1/30/2023; and Barchart.com, Gold Trust Ishares (IAU), 10/1/2022 to 1/30/2023

3 Potential Catalysts For Trend Changes

Big Data Week: Wednesday: The Federal Reserve is expected to hike rates 25 bps to 4.50-4.75%, which is in line with fed fund futures expectations. Thursday: We will hear from both the Bank of England and the European Central Bank, with the first expected to hike rates by 50 bps to 4% (a ”surprise” of just 25 bps is expected by 13 of 42 analysts surveyed by Reuters), and the second expected to go with a 50 bps increase to 2.5%. Friday: The U.S. Labor Department will release its January jobs report. In addition to those anticipated announcements, we will get key data on U.S. employment costs, job openings, factory activity, and productivity.

State of the Job Market: The labor market broadly improved across the U.S. last year. Every state added jobs in 2022, but the pace of gains varied widely. The national unemployment rate fell to a seasonally adjusted 3.5% in December, which matched the lowest reading in 50 years. Some states had significantly lower rates. Utah had the nation’s lowest rate at 2.2%, and North and South Dakota also pulled in sub-3% unemployment rates, along with several other states.

The Path Forward? Federal Reserve officials will meet this week to discuss how much more to lift interest rates both for this meeting and in the long run. Key to those discussions will be guessing how much their previous rate increases have already cooled growth and inflation. The Federal Reserve’s preferred inflation gauge, the personal-consumption expenditures (PCE) price index, rose 5% in December from a year earlier, which was the slowest annual gain since September 2021. The core PCE-price index, which captures underlying inflation after removing volatile food and energy prices, rose 4.4% from a year earlier, its slowest pace since October 2021.

Sourcing for this section: The Wall Street Journal, “Fed’s Interest-Rate Strategy in 2023 Hinges on How Quickly Rate Increases Slow Economy,” 1/30/2023; Investing.com, “Week Ahead: Central Banks and Jobs Reports to Dominate the Headliners,” 1/30/2023; Nasdaq, “Euro zone bond yields rise after hot Spanish inflation data,” 1/30/2023; The Wall Street Journal, “The Jobless Rate Is at a Half-Century Low. In These States, It’s Even Lower.,” 1/28/2023; and The Wall Street Journal, “Consumer Spending Fell 0.2% in December as Inflation Cooled,” 1/27/2023

The Adaptability Of a Systematic Investing Approach

Realize deeply that the present moment is all you ever have. Make the NOW the primary focus of your life.

—Eckhart Tolle

A common theme we are observing in the markets right now is “first time in a while.”

For example, it’s the first time in a while that foreign developed markets are the strongest equity segment geographically. It’s the first time in a while that we’ve had any uptrend in emerging markets – same with U.S. fixed income. Within fixed income, it’s the first time in a while that longer duration is outperforming shorter duration. That’s multiple firsts in the last year or so, all hitting at the same time as we enter February. As readers might expect by now, these market firsts are translating to firsts in a while” for our portfolios as well.

For us, this highlights the adaptability of a systematic investing approach to asset management.

Because our strategies are rules-based, we can perform historical tests to determine how our strategies are likely to perform in various environments, rate cycles, and economic climates. We have built up a tremendous amount of confidence in our strategies because of these tests.

However, our rules-based framework for strategy development also leads to some interesting questions.

One of the great questions we receive is about how we can be confident our strategies will continue to work in the future if the future is unlikely to look like the past. The answer, in our view, has everything to do with adaptability. It is our belief that more adaptable strategies are less reliant on past events and thus more strongly positioned to perform well in the future. The current market environment is a prime example.

Allow us to explain…

Every strategy makes assumptions and creates constraints for itself. For example, a strategy that will only buy and hold the S&P 500 has historically performed ok on an absolute basis. However, if U.S. stocks ever enter a Nikkei (Japan’s S&P 500 equivalent) Index-style decline, then it will likely perform poorly. In other words, a strategy of buying and holding the S&P 500 is only as good as the index it is tied to. The index is completely dependent on the environment in which it operates.

On the other hand, a strategy that can go both long AND short the S&P 500 index has likely underperformed a buy-only strategy over the last few decades. Yet, since it is more adaptable, it should perform better in that Nikkei-style decline we just mentioned. Someone who allocates to this strategy is making a bet that being more adaptable is better, despite the recent performance of the two different strategies (long only vs long/short). Due to the strategy’s adaptability, it is less dependent on the environment for its success. It is important for investors to remember that for every unit of adaptability, one must generally accept at least one unit of potential underperformance versus less adaptable strategies (i.e., indexes).

Now let’s bring the adaptability theme full circle to shed light on the question about how our strategies might perform if the future looks different than the past. Our firm operates strategies with varying levels of tactics and thus adaptability.

The composition of each strategy shifted dramatically over the past 18 months. For example, our portfolios were overweight growth stocks in 2021. Then, thanks to our systematic investing process that use trend following, the portfolios were much more value-oriented in 2022 and early 2023. Similarly, our strategies now have a much higher allocation to foreign developed equities, following almost a decade of generally being underweight. Lastly, bond duration is also much higher today than during the past 12 months, as the trend in longer-term bonds has strengthened.

This adaptability means our strategies are not dependent on whatever factor is driving performance at any point in time. It’s almost as if the past does not exist (and neither does the future)!

How is this accomplished within our framework? The longest timeframe we consider as part of our systematic investing rules is the last 200 trading days. Data prior to the last 200 days is ignored.

Sometimes people are surprised to hear that the longest timeframe accounted for by our systematic investing process is only 200 days (at most). But, our experience and historical stress testing of the data shows that this timeframe is sufficient to support clients reaching their financial goals. confidence that will continue.

That said, we’ll repeat something we said earlier: All strategies make assumptions. We make an assumption that the assets in our portfolios will go up over the long term to help us earn the return we expect. We also make an assumption that the historical behaviors of stocks relative to bonds will continue in the future, which influences the baseline allocations we use when constructing our portfolios. These assumptions put us in line with the vast majority of the portfolio management universe.

The key difference between the rest of the universe and us is that we let price trends tell us what to do in the moment, tactically. It is this adaptability and nimbleness that allows us to rotate exposures relatively quickly. It allows us to be less captive to the past and therefore eliminate our reliance on the future needing to look like the past. We believe this provides a portfolio management infrastructure.

Sourcing for this section: Barchart.com, FTSE Developed Markets Vanguard (VEA), 1/1/2017 to 1/30/2023; Barchart.com, S&P 500 SPDR (SPY), 1/1/2017 to 1/30/2023; Barchart.com, FTSE EM ETF Vanguard (VWO), 1/1/2027 to 1/30/2023; Barchart.com, 20+ Year Treas Bond Ishares ETF (TLT), 1/1/2021 to 1/30/2023; Barchart.com, 7-10 Year Treasury Bond Ishares ETF (IEF), 1/1/2021 to 1/30/2023; Barchart.com, 3-7 Year Treas Bond Ishares ETF (IEI), 1/1/2021 to 1/30/2023; and Barchart.com, 1-3 Year Treasury Bond Ishares ETF (SHY), 1/1/2021 to 1/30/2023

Let's Talk

If you have any questions about what transpired in the markets last month or portfolio positioning for the month ahead